Lenders require Loan Management software for a number of reasons: Software for loan Management increases client satisfaction Loan Management software enhances efficiency Loan Management Software saves time by reducing error.

Customer Website

Customer Login

Get a dedicated website for your lending business with RocketFlow Loan Management Software. Users can register, manage accounts, repay loans through website.

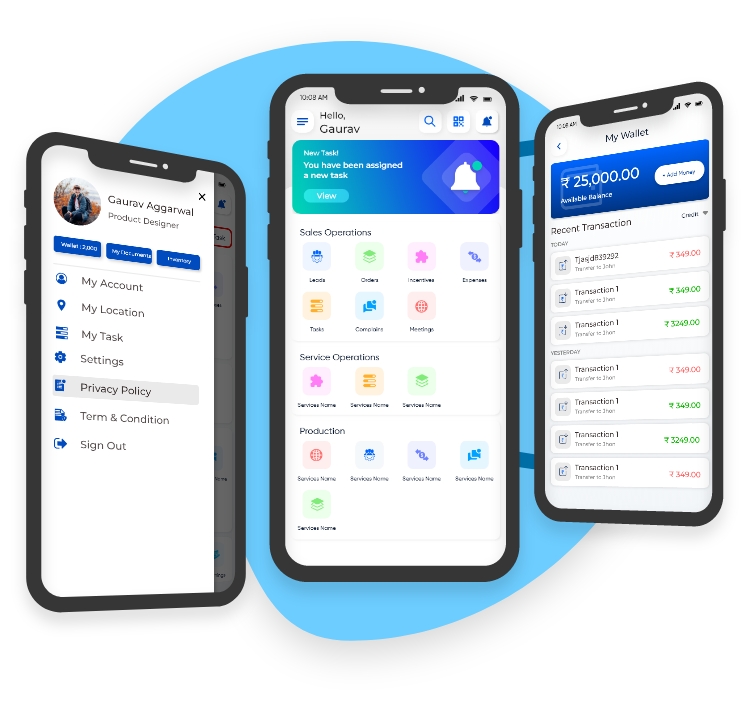

Upload KYC and Verification

RocketFlow Loan Management Software is Pre Integrated with KYC Verification platforms.

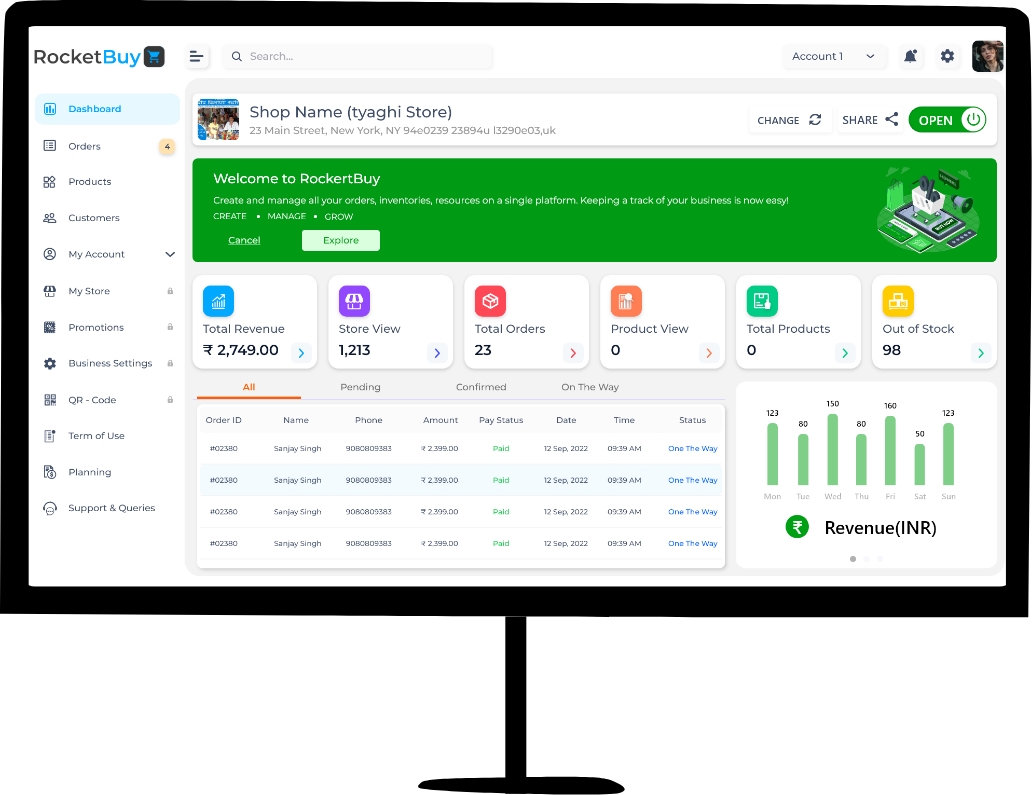

Know Eligibility

RocketFlow Loan Management Software helps you define rules for credit decisioning, customers get to know in real time their eligibility for loan based on the information provided.

Logistics

Logistics

Automotive

Automotive

Manufacturing

Manufacturing

Real Estate

Real Estate

Fleet

Fleet